News of Agribusiness Index

09.12.2016

Business climate in the agriculture sector of Ukraine improves significantly

APD and UCAB have conducted the fourth survey on agri business climate index (ABI), which consists of agri business climate, representing an evaluation of current economic situation and expectations, as well as of agri business index, which indicates changes in the evaluation of the current situation. Mainly individual households but also crop producers have significantly increased their evaluation of agriculture business climate in Ukraine. The surveyed agriculture producers link the enhancement of business climate particularly to the impact by general policies as well as to state support for agriculture.

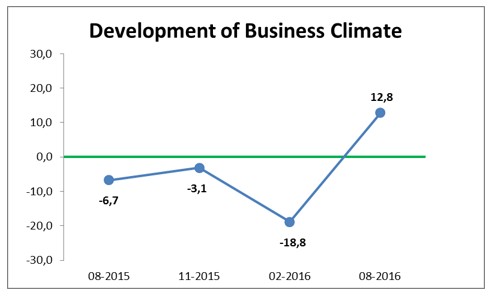

In August 2016, for the first time since implementation of ABI, the agriculture business climate of Ukraine indicated to positive evaluation by agri business, namely to +12.8 points. Business index of the agricultural sector, which represents the change of business situation in comparison to August 2015 gains from 102.7 in November 2015, over a drop on 96.4 in February 2016 to a significant increase now up to 114.6.

The current survey has shown that agriculture producers evaluated some business factors with positive impact on business climate, e.g. (i) access to modern machinery and equipment, (ii) productivity level, (iii) access to qualified employees with professional knowledge (+37.8, +32.9 and +20.0 points accordingly). As most negatively influencing factors were indicated: (i) impact of general economic situation, (ii) government’s support and subsidies, (iii) access to third party capital (-45.5 points, -41.4, -26.0 accordingly). The business index indicates to improvements for nearly all issues surveyed, whereas evaluations for (i) access to third party capital and (ii) access to qualified employees have decreased and show an index of only 95.1 respectively 96.5.

Business climate has improved within all regions of Ukraine and amounts now to + 13.0 points in Central, + 29.9 points in Southern, + 7.7 points in North-Eastern and + 1.8 points in the Western regions of Ukraine. Most significant are positive changes in the evolution of the business situation in Southern and Western regions. Business Index has reached here 116.1respectively 109.8.

All analyzed producers, differentiated by size of their land bank, refer to improvements of the business climate. Evaluation of business climate range between individual producers (+ 4.1 points) and agri holdings (+ 40.6 points), which seems related to large scale economy effects. Evaluation of business climate by farm enterprises ranges between these two groups. Accordingly, the business index of individual producers has reached with 127.2 the highest value among producers groups.

With regards to the evaluation of different types of specialization business climate was mentioned by mixed households at the level of +4.1 points, animal specialized entities – at the level of +6.6 points and crops oriented companies – at the level of 24.9 points. Better business opportunities in crop production seem to play their role. Again, the biggest shifts in the evolution of business situation can be observed for individual mixed producers, reaching with 127.2 the highest index here.

Note: Business index of Ukrainian agro industry (ABI) was developed and introduced by common efforts of German – Ukrainian agro policy dialog (APD) and association “Ukrainian Agribusiness Club” (UCAB) on the base of German general business index. The index is estimated quarterly. “Business index” demonstrates subjective estimations of changes in the evaluation of the business situation, normalized currently to the beginning of the survey in August 2015 (values over 100 indicate to improvements, index below 100 suggest degradation of business situation). “Business climate” determines subjective estimation of both current business situation and one year business expectations. Business climate may change from -100 (very poor) over 0 (indifferent) to +100 (very good).

Overall ABI methodology can be reached here: /ua/ukab_proponue/abi/